IBM Takes Lead in Blade Server Market

Blade Server market - on steroids

Blade Server market - on steroids

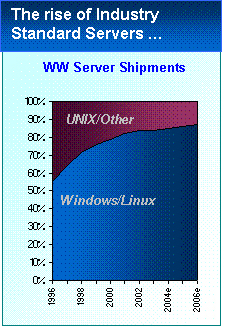

Much as explosive growth in shipment of industry standard servers using Windows or Linux has so far occurred using rack configurations, migration to blade servers using 2-way Intel based blade servers has started in earnest.

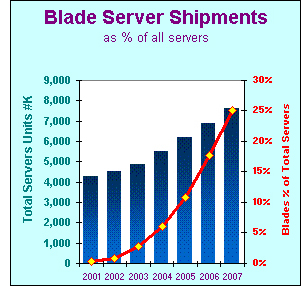

IMEX Research believes that by 2007, almost 25% of unit shipments will end up as blade configured servers.

Volume economics - the growth driver for modular servers

The Data Centers migration is underway to leverage the volume driven economics of industry standard servers using Linux/Windows operating environment. The integrated modular architecture of blade systems providing Virtualization, Provisioning and Self-Driven Automation capabilities already are

starting to strike a pleasant resonant chord with CIOs. According to IMEX Research, a technology research company based in San Jose California, Windows/Linux Server shipments will capture 85% of the worldwide market for servers using modular servers using both rack-wide and blades server configurations.

Some of the major growth drivers accelerating this phenomenon include:

Some of the major growth drivers accelerating this phenomenon include:

• UNIX to Linux Migrations to leverage cost effectiveness of open source Linux

• HPC Linux Clusters have struck an explosive growth in academia, national laboratories for scientific computing and migrating to commercial world for Bioinformatics, decision support financials, visualization etc.

• Server Consolidation onto fewer servers with virtualization of resources, provisioning and lights out automation capabilities

• Blades Density to provide economic benefits in real estate and operational environmentals.

• Standardization on fewer OS types for servers, storage and network protocols deployed.

A new de facto blade server standard emerges

Improved hardware provisioning provides a compelling value proposition for blade servers, but lack of standardization is undermining this message. Each server vendor initially has attempted to create proprietary designs to protect margins and secure long-term footprint in data center configurations. This lack of standardization is impeding adoption, as customers want standard form factors supported by multiple vendors.

IBM has made Blade servers as a cornerstone of its x-series (Intel) product line and is heavily pushing its BladeCenter along with larger SMP computers. To mitigate concerns of non-standardization and to leapfrog other competitors IBM chose to parlay its relationship with Intel to create a partnership in which the two companies share technology and development costs for blade server designs and drive a de facto standard. IBM is hoping that the partnership will drive the commoditization of blade server hardware, allowing the company to win the day on its superior software and services. In exchange, Intel got a faster ramp in blade server designs and the blade market and, in turn, allows Intel to drive volume of its Xeon (and later Itanium) processors into higher performance, higher margin enterprise markets.

On the heels of Intel/IBM 7U blade standard, Fujitsu Siemens in Feb 2003 announced its 7U high 2-way BX600 Blade Server boasting features that outshine its competitors in optional features set, to address the midrange Tier-2 & 3 marketplace. Several of the Intel's Blade Server OEMs have started to provide advanced features and storage connectivity options rivaling Intel. In the wings, Supermicro and other manufacturers are getting ready to shortly introduce 7U high versions of blade servers.

Intel spreads its wings in blades

Intel is now selling its BladeCenter “clones” to other OEMs. It has garnered almost 40 OEMs and System Integrators worldwide including such computer makers as Bull Computer of France, Gateway in the US in addition to several system integrators in Europe (Anders & Rodewyk, Bull SA, DGC Products AB, Kraftway, Maxdata, DigitalHenge, Melrow Technology, NEC HPC, Transtec AG), US (Aspen Systems, BOXX Technologies, Ciara Technologies, Coastline Micro, Cobalt Computers, Concentric Systems, Dedicated Computing, DigitalScape, Equus, General Data Systems, Itantec, ION Computer Systems, Open Storage Solutions, Promicro, QSOL, Rackable, Silicon Mechanics, Terian Solutions, U.S. Micro PC etc.) and Asia Pacific ( Lenovo/Legend Group, Langechal etc)

Some sources indicate Hitachi, Unisys and even Dell and giving consideration to a license agreement with Intel for the BladeCenter design in order to accelerate their blade server roadmaps.

Some Asian ODMs (Original Design Manufacturers such as Quanta, Mitac, Arima, FIC etc.) that are the major suppliers of notebook and motherboards to US PC and Server manufacturers are waiting in the wings to jump into the Blade Servers market, as soon as de facto standards crystallize further.

(See IMEX Research Report: Competitive Analysis of Startups

and Incumbents in Blade Computing & Communications

Document RPT-115 Jan 2004)

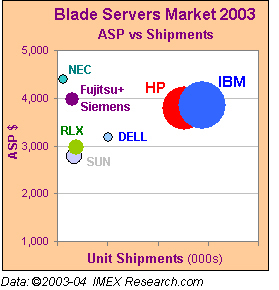

IBM the new leader in Blade Servers

On the heels of paying attention to the true needs of the marketplace, a well-executed strategy and joint development with Intel, IBM has whizzed past others to become the new leader in the blade server market in 3 rd and 4 th quarter 2003, both in revenues and shipments, according to IMEX Research, a San Jose CA Technology Research & Consultancy.

Sun, Dell, and Fujitsu-Siemens entered the market in the tier-1 market segment. (Internet access servers with network throughput-oriented workloads) underestimating the capabilities of multiprocessors used in blades to handle the high-end tier-2 and -3 transaction workloads.

Sun, Dell, and Fujitsu-Siemens entered the market in the tier-1 market segment. (Internet access servers with network throughput-oriented workloads) underestimating the capabilities of multiprocessors used in blades to handle the high-end tier-2 and -3 transaction workloads.

On the heels of success of IBM, all of them are now targeting the high-end blade server market. Fujitsu recently announced its RX-600 high-end blade server – a well-positioned product with excellent features and options. Sun moved to a 2-way product as a precursor to targeting the high-end transaction-oriented blade server.

IBM, on the other hand, has introduced a 4-way server blade and is expanding its blade server product line to Telecom server markets.

Dell is championing the establishment of server management software standards, taking the lead in the recently formed server management group in DMTF organization.

The blade server market will belong to vendors who can corral volume-driven economics inherent in blade servers. The challenge is up to Dell to harness this market with well-featured and positioned products.

(See Blade Servers Industry Report 2004 – IMEX ResearchDoc.BS-203 Feb.2004

and IBM – the new leader in Blade Servers - IMEX Research Brief BR-130 March 2004)

About IMEX Research

IMEX is a research and consulting company in technology markets with expertise in the fields of Blade Servers/Modular Computing, Network Storage (NAS/SAN/iSCSI), High Availability systems (Computing and Telecom), and Optimal Four-tiered Computing Infrastructure (Access, Web, Application and DB/Transaction Tiers).

The company tracks technologies, market dynamics and industry directions and provides its clients with market opportunities by market segments, forecasts and shares, insights on enabling technologies and standards, competitive positioning of start ups and incumbent suppliers and their strategies.

IMEX also provides consulting and advisory services in product and

business planning, competitive analysis, product specs and key

feature-sets, go-to-market strategies including pricing structures and

distribution channels (OEMs, VARS/SI, Service Providers, Distributors by

Vertical Markets-Telecomm, Financials, Health Care etc.) as well as due

diligence and recommendations for affiliations and

acquisitions.

--------------------------------------------------------------------------------

Click on the following industry reports or go to http://www.imexresearch.com/ for

more information:

![]()

![]()

![]()

![]()

![]()

Click here for any feedback or removal.