| iSCSI SAN's: The Future of IP Storage Click on Executive Summary and Table of Contents for additional information.

|

|||

SMB Moving Towards Networked Storage |

|

||

|

Forced by growing business demands for storage and a need for better storage management options, small and mid-sized companies are moving away from DAS in flavor of SAN and NAS. SMBs that are in the market for externally attached storage solutions most often shop within the $5k-$10k and $10k-$25k price bands. Since external DAS arrays are block I/O devices, it is reasonable to expect a large portion of this market to utilize block-level networked storage (i.e., SAN). Couple this with the very price-sensitive nature of such environments and it is a perfect storm fueling iSCSI array growth.

|

|||

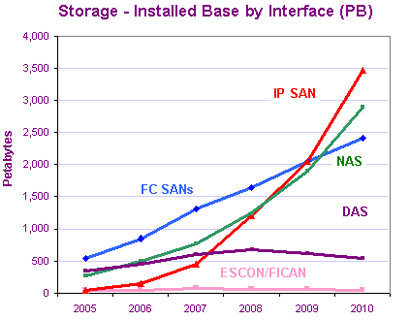

| The adoption of Microsoft's Exchange Server 2007 is expected to drive market growth for iSCSI. An IP based storage networking standard that uses TCP/IP to transfer data, iSCSI needs only an Ethernet interface to link data storage facilities. It is far less expensive and simpler than Fibre Channel. Because many Exchange environments are on existing Ethernet networks, iSCSI lends itself to be a perfect match. IMEX predicts a 75% increase in iSCSI revenue between 2005 and 2010. |

|

||

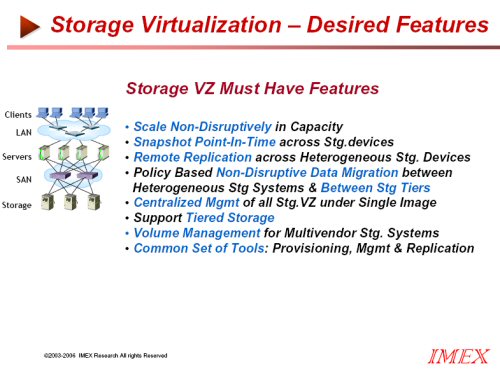

| Technology Drivers The iSCSI has largely been fuelled by the availability of affordable Gigabit Ethernet-connected storage solutions supporting Windows host environments. This market will continue to grow rapidly as DAS declines. Further market expansion is now starting to be driven by the availability of complete storage solutions capable of supporting business-critical application environments running on other host platforms such as Linux, AIX, Solaris and VMWare. Another driver of market expansion will be 10 Gigabit Ethernet (10GigE). Thanks to 10GigE iSCSI now offers faster throughput rates than FC SAN and will continue to do so when FC SAN gets to 8Gb/s later next year. While 10GigE equipment still is fairly expensive, it is widely expected that prices will drop quickly when the market uptake accelerates. A recent Byte and Switch poll showed that 76% of storage managers have already implemented 10GigE in their infrastructure or are considering doing so. Moreover the arrival of 10GigE will also accelerate the decline of 1GigE equipment prices. Two other technology drivers are the growing popularity of blade servers and virtualization software, as both play an important part in the ongoing trend of server and storage consolidation. Blade servers, the low-cost modular alternatives to legacy stand-alone servers, don't have internal storage and, as such, have to rely on networked storage. Meanwhile, server virtualization software makes it much easier to share and pool storage resources, thereby providing a fertile breeding ground for networked storage. The Roadmap for iSCSI Positioning iSCSI SANs as a better price/performance solution than Fibre Channel SANs – 80% of the functionality at 20% of the cost is the target of many Storage Solution Providers such as Intransa, StoneFly Networks and others. With Microsoft driving adoption, interoperability and compatibility would not be much of a problem for this technology to move forward quickly. The performance of iSCSI over Gigabit Ethernet is nearly on par with Fibre Channel today, and 10Gbps Ethernet will eventually overshadow Fibre Channel's performance, enabling iSCSI to move from SMBs to the enterprise. As iSCSI moves into enterprise environments, virtualization will no doubt become an integral part of the expected set of requirements for IP SANs. Virtualization simplifies complex storage environments. The iSCSI hurdles in product/technology architectures and market adoption in areas of:

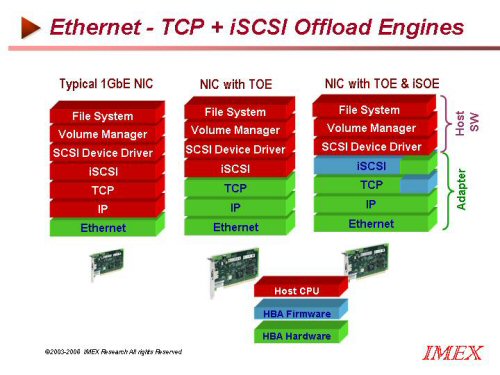

FUD from Fibre Channel SAN proponents (established FC incumbents like EMC , Brocade, McData, StorageTek etc. who have a lot to lose) are being addressed by: TCP and iSCSI Offload Engines offered by qLogic, Intel, Adaptec Agilent and others. Currently, iSCSI accounts for a relatively small part of the total storage revenue. While the total storage revenue is expected to grow annually by less than 2% on average in the 2005-2010 timeframe, we predict 70-75% compound annual growth rate for iSCSI SANs during the same period. This means that by 2010, IMEX estimates that iSCSI will account for about 8-10% of total storage revenue and over 15% of SAN revenue. 10GbE will accelerate adoption of iSCSI. The pricing for 10Gbps Ethernet will have to come down significantly before the technology causes an appreciable increase in iSCSI SAN adoption. Storage Virtualization In recent years, no storage innovation has created more fervor than virtualization. The many benefits of storage virtualization are; less downtime, better overall storage performance, fewer instances of lost data, the ability to aggregate LUNs, and lower costs. Few would challenge the notion that iSCSI is becoming a manageable, cost effective alternative to Fibre Channel. iSCSI encapsulates data and SCSI metadata (commands, status, etc.) for delivery to target devices in block format much like Fibre Channel. However, Fibre Channel requires a dedicated network and specialized HBAs and switch ports, as where iSCSI can be networked over conventional TCP /IP-based Ethernet infrastructure. A lot of the companies implementing iSCSI are new adopters of SANs and they're using low-cost SATA arrays. Virtualization allows you to slice and dice any type of disk array, from any manufacturer, which is in line with the low-cost value proposition of iSCSI. IMEX Estimates that 80%-90% of iSCSI users are also using virtualization.

IP Storage Report 2007 IMEX Research's Industry Report on IP Storage addresses the needs of Vendors (Semiconductors, Boards, Subsystem and System Manufacturers), Go-to-Market Direct and Indirect Channels (System Integrators, VARs and Distributors), End Users by Vertical Industries and Investors/VCs in pointed ways: For the end users the report provides: • Prescriptive guidance based on experiences of early adopters sharing their experiences of implementing and managing IP Based Storage Solutions. IP Storage is leveraging the volume driven economics of IP everywhere to create a new wave of storage interconnectivity to build an integrated native IP storage network that will transport data seamlessly in local (LAN), metropolitan (MAN) and wide area networks (WAN) environments. For the vendors , the report provides a comprehensive look at the current and evolving industry and the opportunities, pitfalls and outlook on virtualization encompassing 10 chapters • Executive Summary |

|||

| Click on the following for additional information or go to http://www.imexresearch.com

IMEX Research, 1474 Camino Robles San Jose, CA 95120 (408) 268-0800 http://www.imexresearch.com |

|||